Institutional Insights

Evaluating an agent lending provider

Strategic questions to consider when going through the selection process.

Key Takeaways

- A consolidation of providers is underway due to profitability concerns, significant investments in technology and staffing, or a strategic realignment to focus on core businesses. Some agents are making changes to program elements like indemnification, the fee structure, or minimum spread thresholds to shore up their bottom line. As such, RFP activity is likely to rise as firms seek a new agent lending provider.

- Key signs that it may be time to evaluate your firm’s current agent lending provider include declining revenue or consistently underperforming the benchmark, an increase of compliance violations and operational issues, regulatory changes, etc.

- The selection process should examine an agent lending provider’s commitment to and investments in their securities lending program, their capacity to react to regulatory changes, how borrower default indemnifications are handled, and other factors that are meaningful to your firm.

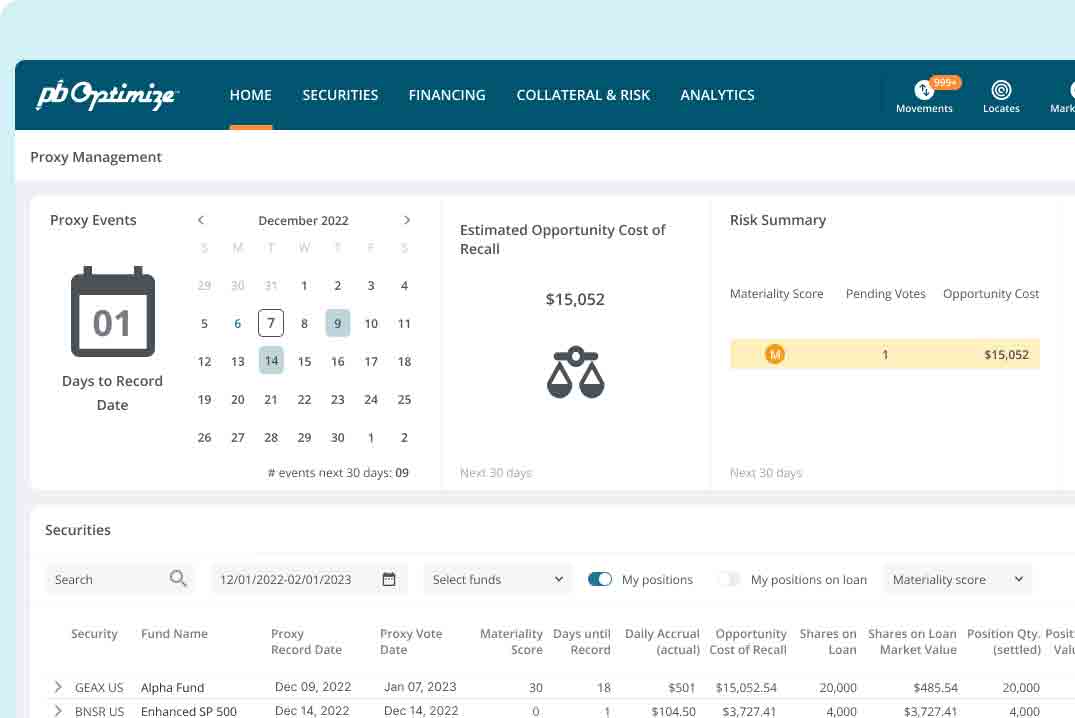

- A deep analysis of the technology and the program is necessary to determine a best fit with your firm’s goals and fiduciary needs. Factors that are important to the analysis are: how advanced the technology is, how is operational risk mitigated, what percentage of lending transactions are automated, how are proxy votes managed, what types of program parameters are customizable, etc.

- A leading agent lending provider should have advanced technology and risk models, deep capital markets expertise, customizable program parameters, operational and service excellence, unique benchmarking and transparency tools, and real-time connectivity and automated reconciliations.

Want to know more?

Let’s talk about how Fidelity can help you reach your goals.

Fidelity Agency Lending®

Optimize your firm’s performance with our tech-driven securities lending program.

Fidelity Agency Lending® clients can leverage our fully integrated financial technology platform that provides greater transparency to help make better-informed securities lending decisions.

Explore its key agency lending features, including what-if analysis, analytics and research tools, and more.

Intended for institutional investor use only.

Fidelity Agency Lending® is a part of Fidelity Capital MarketsSM, a division of National Financial Services LLC. Clearing, custody or other brokerage services may be provided by National Financial Services LLC, or Fidelity Brokerage Services LLC, Members NYSE, SIPC.

PB Optimize is provided by Fidelity Global Brokerage Group, Inc. (FGBG), a wholly owned subsidiary of FMR LLC. FGBG is not a part of Fidelity’s broker-dealer entity, National Financial Services LLC, which provides Fidelity’s other prime brokerage service offerings. PB Optimize is a service mark of FMR LLC.