At Fidelity Agency Lending (FAL), we help firms improve returns with a comprehensive, digital platform that manages all aspects of securities lending for asset managers and other institutions.

Our program brings together a range of features that firms are looking for in an agent lender, with a few unique enhancements, like innovative technology and proprietary benchmarking tools. Plus, it’s all backed by Fidelity’s deep capital markets insights and 20+ years of securities lending expertise.

Enhance your securities lending program with the size, scale, and breadth of our strategic operations

- 1. As of 9/30/25.

2. As of 9/30/25, includes Automated & Semi automated loans.

3. Includes business and technology head count through 6/30/25. Does not include shared resources.

Our resources, technology, and experience can unlock your firm’s optimal performance

Many firms are looking for a competitive edge. They want solutions that put their needs first, offer world-class services, and provide a fully customized lending experience. Fidelity's securities lending program aims to achieve these goals by emphasizing:

Improving Returns

Our program focuses on optimizing returns without compromising credit standards.

Providing Safeguards

Our program has borrower default indemnification that is backed by our well-capitalized broker-dealer, National Financial Services LLC.

Customizable Programs

Our tailored program options can align to a firm's unique risk/return parameters, strategic goals, and capabilities.

Increasing Transparency

We believe greater transparency can help optimize returns, while enhancing corporate governance and program oversight.

Minimizing Risk

We use technology that significantly improves data connectivity and trade reconciliations, while offering advanced risk modeling to help minimize risk.

Optimizing Results

Our sophisticated automated lending platform helps efficiently distribute assets and maximize returns for better outcomes.

In the news

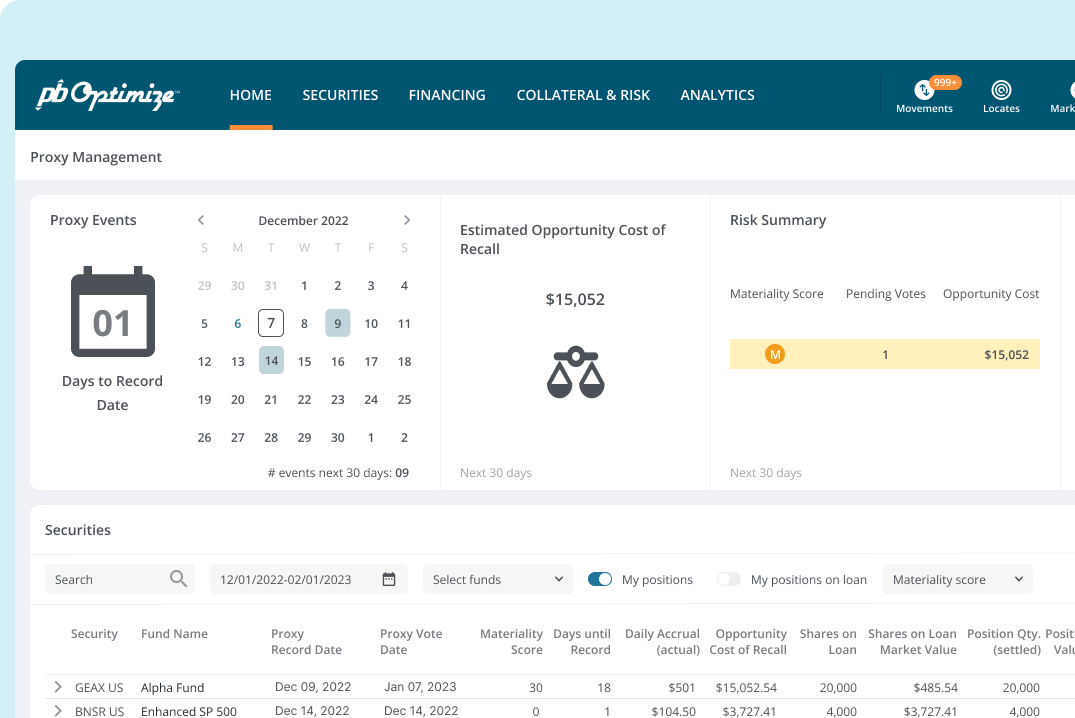

PB OptimizeSM

Explore its key agency lending features, including what-if analysis, analytics and research tools, and more.

A guide to help asset managers and other institutional firms evaluate an agent lending provider for a securities lending program.

Want to know more?

Let’s talk about how Fidelity can help you reach your goals.

Intended for institutional investor use only. Not authorized for distribution to the public as sales material in any form.

Fidelity Agency Lending® is a part of Fidelity Capital MarketsSM, a division of National Financial Services LLC. Clearing, custody, or other brokerage services may be provided by National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.

PB Optimize is provided by Fidelity Global Brokerage Group, Inc. (FGBG), a wholly owned subsidiary of FMR LLC. FGBG is not a part of Fidelity’s broker-dealer entity, National Financial Services LLC, which provides Fidelity’s other prime brokerage service offerings. PB Optimize is a service mark of FMR LLC.