Fidelity offers a simple, integrated proprietary DSP solution for issuers to invite any group of individuals to participate in their IPO and leverage:

Support you can count on

Issuers can focus solely on their offering while our dedicated team handles everything else, from customized DSP solutions to participant communications. We even work with counsel and underwriters. Just provide the names and email addresses for individuals you want to invite, and we take care of the rest.

A flexible hybrid solution

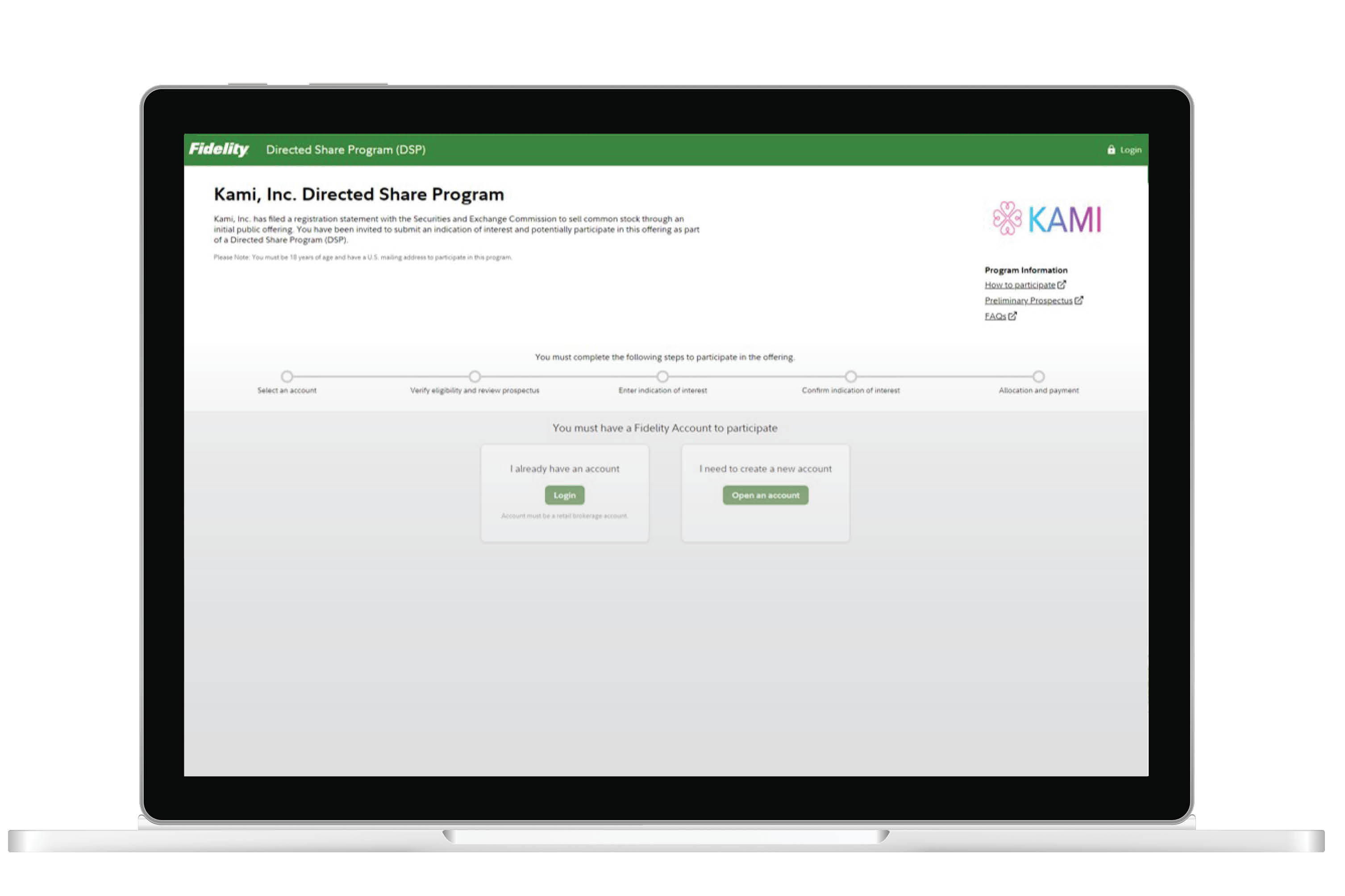

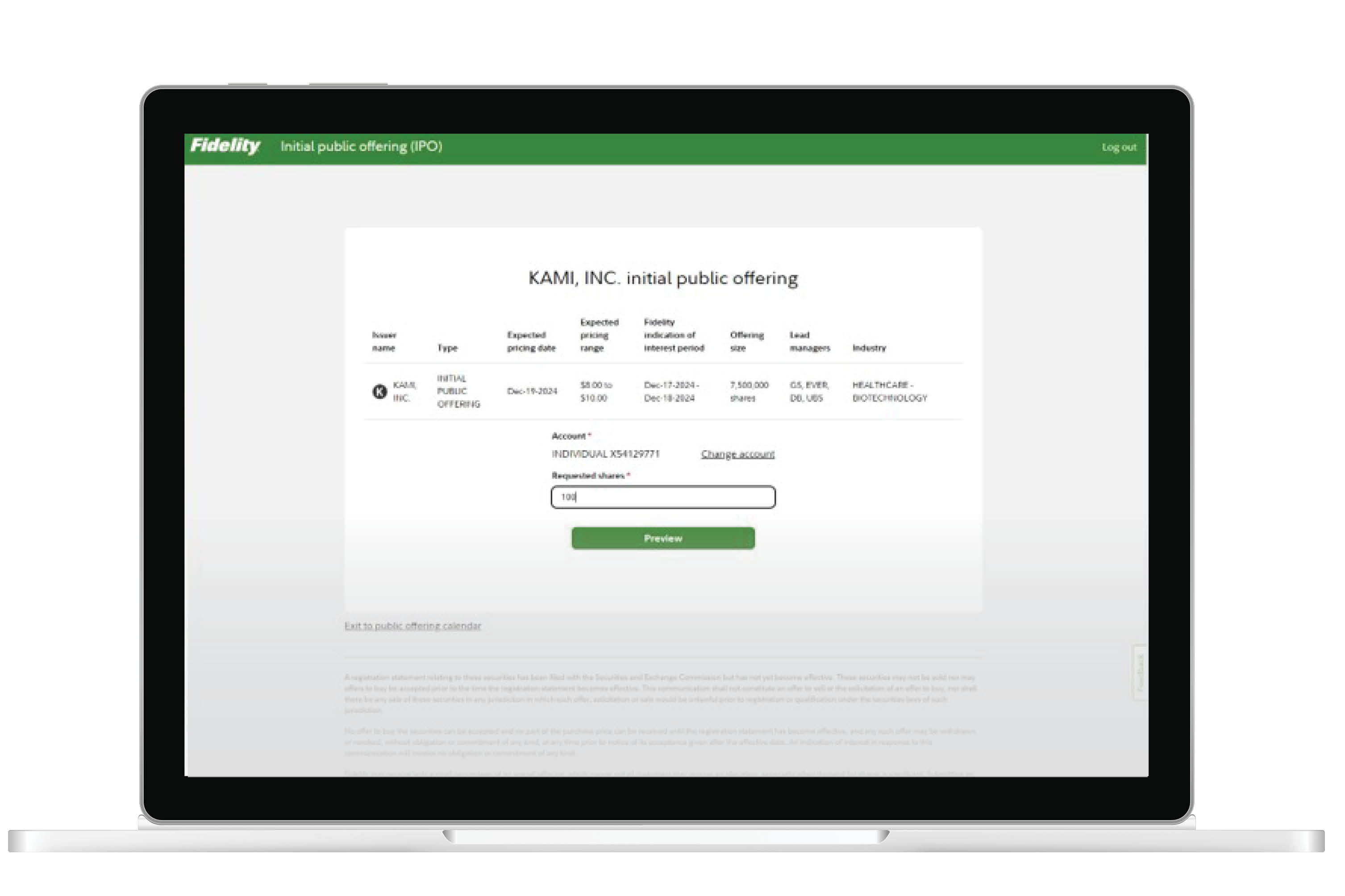

Our proprietary, fully scalable online solution accommodates any number of participants, with easy online steps and real-time progress tracking for issuers. We uniquely offer 24/7 support, ensuring participants get help whenever they need it.

A zero cost DSP

Fidelity manages the DSP for the sales concession on shares distributed at no extra cost to the issuer. Participants can open or use an existing Fidelity account with no fees and enjoy $0 brokerage commissions on Fidelity.com.

Expanded company benefits

Boost your IPO visibility with our DSP solution and recognize those who helped grow your company. Invite employees, customers, even friends and family to participate. DSPs can also help align employee interests with shareholders and signal positive commitment to the market.

Maximize your shareholder potential with Fidelity's DSP solution1

- Since 2000, our seamless DSP management process only requires participant names and email addresses from the issuer.

- Our technology makes it easier than ever for participants to complete each step of the process, including opening an account in minutes.

- Fidelity Capital MarketsSM has managed deals from 5 to over 100K participants and provides invaluable 24/7 support for first-time stock purchasers.

- Fidelity offers issuers access to one of the world's largest retail distribution networks, providing meaningful demand from 'mom and pop' investors with cash accounts.

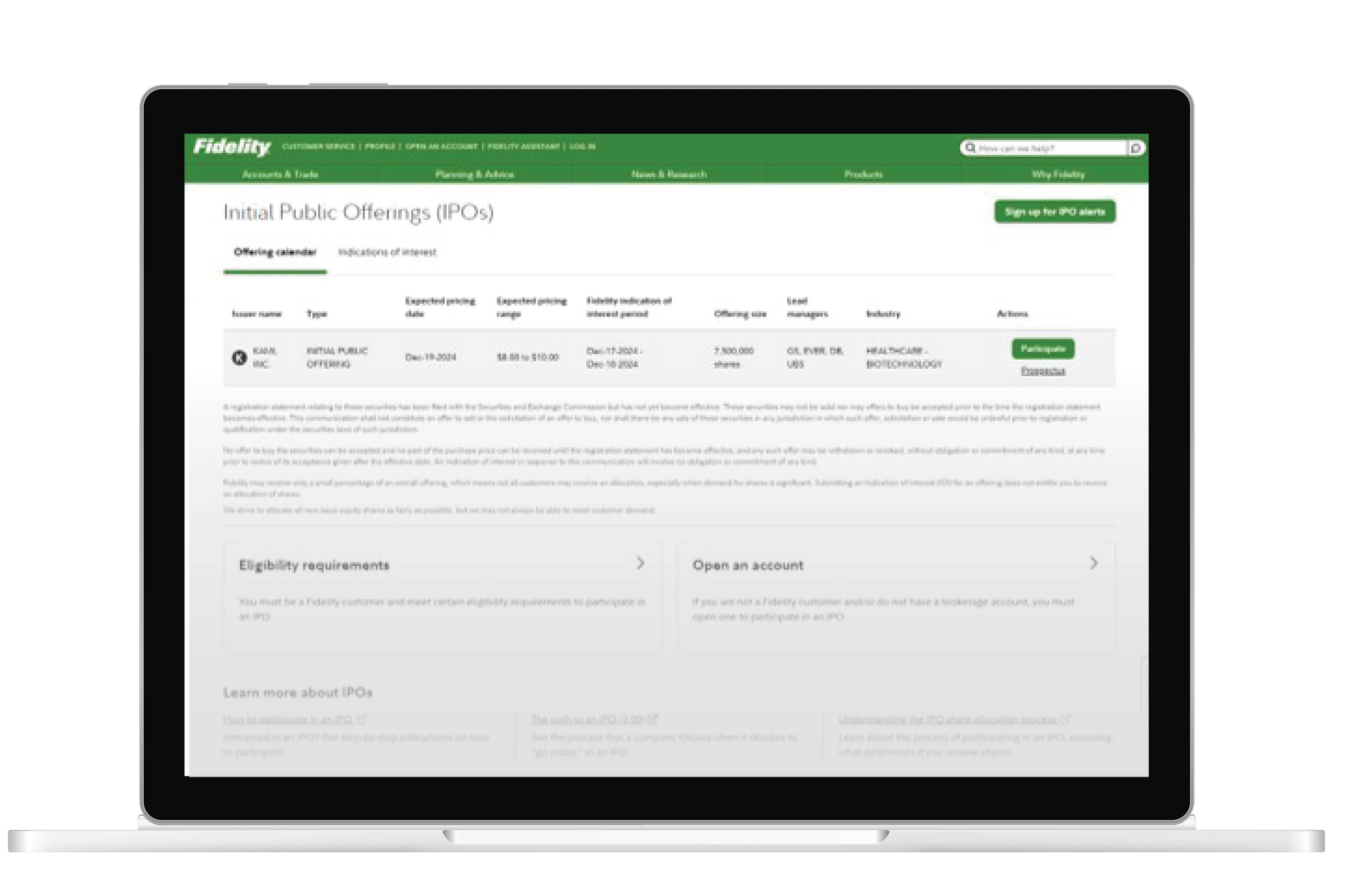

- Increases visibility by posting the offering outside the Fidelity.com firewall, viewable by all customers and prospects.

- Regular announcements to our 300K+ clients registered for IPO alerts.

- Fidelity clients average $24M in demand and over 700 round lot accounts per IPO.2

- Our investors are subject to a flipping policy, with a 1-day flip rate under 1% and a 15-day flip rate under 3% and buy additional shares in the secondary market.3

- Participants bought $61B more stock than their initial IPO allocation.4

Want to know more?

Contact the Equity Syndicate Desk at Fidelity Capital MarketsSM at equitysyndicate@fmr.com or 617-563-0800.

1. S&P and FCM unaudited data since 2014.

2. FCM unaudited data since 2019.

3. FCM unaudited data since 2014.

4. FCM unaudited data since 2014. Includes changes in market value.

For Institutional and investment professional use only.

Fidelity Investments® provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.

155 Seaport Blvd. Boston, MA 02210-2698

© 2024 FMR LLC. All rights reserved.