Brokered Certificate of Deposit Underwriting

Help grow your business with our vast client network

Access more than 43 million investors and 13,500 financial advisory firms1

When you choose Fidelity Capital Markets as one of your certificate of deposit (CD) underwriters, you can leverage our extensive network to help you grow your business. Many of our clients can easily purchase CDs directly at Fidelity.com or on our mobile app.

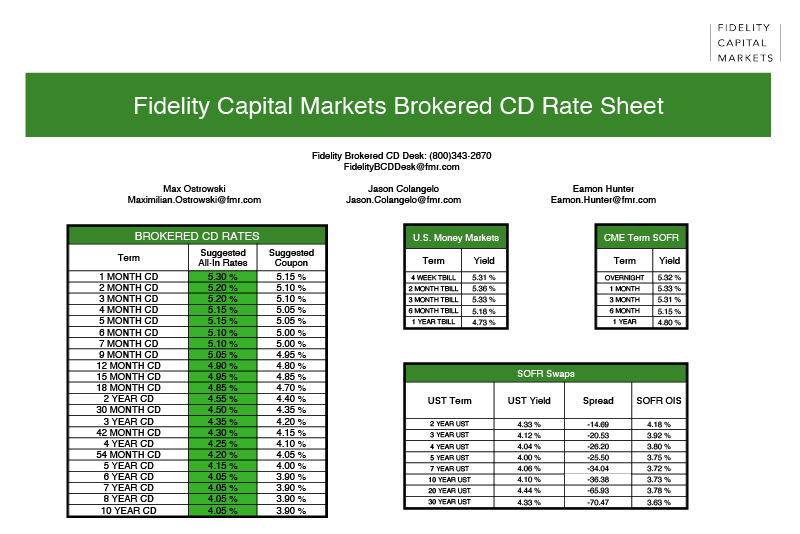

Interested in Receiving Our Weekly Rate Sheet?

CONTACT USRetail Certificates of Deposit (CDs) are a funding mechanism used by commercial banks and thrifts to access a dependable source of low cost deposits.

Financial institutions may participate in Retail Brokered CD programs because they are a cost effective and flexible funding source that can complement their other funding options.

Retail CDs are issued in various terms and structures. They are issued on a continuous or periodic basis to help meet a wide range of financing requirements.

Advantages

-

As a leader in the financial services industry, Fidelity has more than $11.5 trillion in assets under administration, more than 38 million customer accounts and more than 43 million investors.1

-

Helps optimize your deposit-gathering with the extensive distribution capabilities accessible exclusively through Fidelity Capital Markets.

Why Use Brokered CDs?

- Master Certificates—Retail CDs are FDIC-insured time deposits issued to holders in "book-entry" form only. The deposit is evidenced on the books of the issuer by a master certificate reflecting the terms of the issue. Only one master certificate is required for each issue regardless of the number of depositors purchasing the issue or the amount raised by the financial institution.

- Custodian—The financial institution makes principal and interest payments to the Depository Trust Company (DTC).2 DTC is responsible for passing the principal and interest to the broker-dealers. The broker-dealer is responsible for passing the correct amount of principal and interest to the owners of the Certificates.

- Regulatory Requirements—Issuers must be classified as either "Well Capitalized" or "Adequately Capitalized," and have been granted a waiver from the FDIC to accept brokered deposits.

- Ease of Administration—Retail CDs require one aggregate weekly settlement and one fund's transfer at maturity.

- Recordkeeping—Broker-dealers are responsible for maintenance of all depositor records and tax reporting information, and provide depositors with confirmation statements, disclosure documents, and periodic account statements. Tax documents are provided directly to depositors and to state and federal taxing authorities by broker-dealers.

Talk with us and see how we can help you today.

800.343.2760 or FidelityBCDDesk@fmr.com

Intended for institutional investor use only. Not authorized for distribution to the public as sales material in any form.

- "Fidelity by the Numbers," as of 9/30/23.

- Depository Trust Company (DTC) is a member of the U.S. Federal Reserve System, a limited-purpose trust company under New York State banking law and a registered clearing agency with the Securities and Exchange Commission. The master certificates are held by DTC for the bank.